The key to insurance is simple: You insure what you can’t afford to pay yourself. Unlike health insurance in the United States, travel insurance is very affordable and one of the most important things to purchase for any trip!

Why do you need travel insurance?

It covers all the things that go wrong – the flight delay that left you stranded in Istanbul for the night or the bout of food poisoning that hits a few hours before your flight home from Mongolia. Both are true stories from my travel adventures and not fun memories. Both of which I claimed on travel insurance and were covered by my plan. I ALWAYS buy travel insurance for every trip, which usually runs $40-100/month depending on where I’m going. Adventure activities like climbing Kilimanjaro require more coverage and increase the cost.

Keep in mind that many credit cards include some travel insurance benefits. If it’s a very short trip and you paid for everything on your card, then you might not need an extra travel insurance policy. For long-term trips, remote locations and adventure activities, it’s highly advisable to get a separate travel insurance policy.

What does travel insurance cover?

- Emergency Accident & Sickness Expenses. This benefit covers physicians fees, medicines, x-rays and other expenses related to illnesses on the trip. Ambulances, lab tests and therapeutic services are also covered. You need documentation in English about what happened, the treatment and costs. To be clear, this is for when you get sick on the trip and does not cover routine medical care. Emergency dental is usually included in this benefit. (Policies can be really strict about what is categorized as “emergency dental.” I had some tooth pain last year and went to the dentist in Singapore to ensure I didn’t have a cracked tooth. Thankfully, I didn’t, but my insurance didn’t consider this an “emergency” and didn’t cover the x-ray cost, which only $63.)

- Emergency Evacuation & Repatriation. During my first summer working in Asia, a co-worker broke her neck diving into a waterfall in Laos. She was airlifted to Thailand and thankfully, fully recovered. She luckily had travel insurance, which covered her evacuation and flew her mom to be with her in Bangkok until she was well enough to fly home. This is just one example of the most important part of travel insurance – emergency evacuation and transportation for someone to join you if you are traveling alone. This benefit also includes non-medical emergency evacuation due to civil unrest, a natural disaster, etc. Accidental loss of life, dismemberment and repatriation of remains are also part of this benefit.

- Trip Cancelation, Delay or Interruption. Trip cancelation and interruption includes sickness, injury or death of yourself or a family member, jury duty, inclement weather, terrorism and the destruction of your principal place of residence. For trip delay, benefits usually kick in after a six-hour delay. You have to provide the original proof of purchase for any travel, proof of the delay, receipts for your expenses and proof of any refunds or cancelations. For medical issues, you’ll need a doctor’s note stating why you can’t travel.

- Baggage Delay & Damage. Most policies have some benefit for loss, damage or delay of both checked and carry-on baggage. Usually, they pay $3,000 maximum for this benefit and up to $250-500 per item including electronics. Passports are often covered by this benefit as well. A police report is required for stolen items. (FYI: Reaching out to the airline is another option with baggage issues. When my luggage showed up in Boston with water literally pouring out of the bag after a three hour rain-delay, I reached out to the airline directly who reimbursed me for my camera chargers and gave me flight vouchers.)

- Lost or stolen property. Some policies will cover lost or stolen goods. Often a police report is needed within 24 hours of the incident. You will be required to produce the original purchase receipt for any electronics or other expensive items. Policies will either pay to replace the item or pay you the value of the item. Some polices set a limit of $250-500 for electronics. Let’s be honest the average cell phone and camera cost more than this so be sure to do you research!

What Travel Insurance Does NOT Cover

Routine Medical Care

Policies are not going to cover an annual physical or routine dental care. Check out my post on Going Abroad for Medical Care for details on this.

Stolen Cash

Cash is never covered. Put your cash in multiple places and NEVER have all your cash, credit cards or passport with you at the same time especially in places with high theft rates like Barcelona. I’ve had two purses stolen so trust me on this one or you’ll end up living in a Western Union commercial calling your parent’s from Cambodia at 5 a.m. It’s not a fun place to be.

Pre-existing Conditions

Most polices will not cover pre-existing conditions, BUT they do normally state they will cover an “acute on-set of a pre-existing condition.” For example, I had an old running injury flare up in Thailand several years ago. I went to the hospital for x-rays and my travel insurance covered it since it was an unexpected reoccurrence. According to all the policies I’ve read doing research for this post, the definition of pre-existing means it existed when you bought the policy or 120 days before depending on which policy you choose. (When you file a claim, most companies want you to list all conditions you were treated for in the past five years!)

Some Adventure Activities

There are limits to what is included in the basic plan. Most cover snorkeling and other basic things like kayaking. Some companies offer an additional wavier for adventure activities. When I climbed Kilimanjaro, I used World Nomads because they covered hiking at a high altitude. Other companies would not cover me over 14,000 feet, but Kilimanjaro is just over 19,000 feet.

Alcohol or Drug-related Injuries/Death

If you are under the influence of alcohol or drugs when an incident occurs, you will not be covered by the plan. Make good decisions.

Motorcycle Accidents

For travel insurance to cover you, you must have a license in the county you are driving in or meet the countries requirements to drive legally. This means you are NOT covered in most of Southeast Asia especially Vietnam. This is IMPORTANT so don’t ignore this! (Check out this interview with World Nomads on the Sept. 13th episode of the Postcard Academy podcast for more details!)

How do you get reimbursed?

The standard procedure is that you pay out of pocket then are reimbursed. It normally takes 30 days after a claim is filed to be reimbursed. I find it takes longer if your claim is complicated. If you put these costs on a credit card, be warned that you might not be paid back before the credit card bill arrives. Insurance does NOT cover interest fees on credit cards. (Earlier this year, I found IMG to be taking four months to reply to claims, which is making me hesitate to ever use them again.) In the past, both IMG and World Nomads, paid or responded in exactly 30 days from the claim submission date. If you have an evacuation, then some polices might cover that cost upfront. Check the fine print for details.

Also, the paperwork required for claims can be time consuming. Be sure to keep records of everything – you’ll need a doctor’s report and all receipts! This will make it easier when filing the claim.

Tips for Buying Travel Insurance

Research Deductibles

I always try to buy $0 deductible policies. Be sure you are aware of any and all deductibles so they aren’t a surprise later.

Read the Fine Print

I have trust issues when it comes to anyone selling insurance or working in the medical industry. I never believe anything they say until they show me where it’s written in the terms and conditions for the plan. Remember YOU are the one signing that document saying you understand the plan or are responsible for those medical fees, not them. Make sure you can find the exact wording for any activities or questions you have in the fine print! (I wrote an ENTIRE chapter in my book, Good With Money, about how to cut medical costs in the U.S. You really have to understand the system! All insurance is a profit-driven business and doesn’t have your best interest at heart!)

Home Country Coverage & Coverage in America

Only a few companies offer coverage in the U.S. for residents. (World Nomads and Allianz both offer U.S. coverage if you are at least 100 miles outside of your residence.) If you are not a resident of the U.S., there are more options available to you for coverage in the U.S. but your premiums will double. No matter where you live, be sure to research coverage options in your home country in case you go back for a visit!

Pre-existing Conditions Policy

This is a grey area. If it’s a “unexpected” reoccurrence, then it can be covered. I can’t stress this enough – be sure to read the fine print to see your options! (Be prepared to list all doctors and addresses of places you’ve been treated in the last five years on the claim form!)

Electronics Coverage

The coverage limits for electronics is tricky. Most policies will only pay a flat fee of roughly $250. Let’s be honest – most smart phones cost more than that! I bought Apple’s AppleCare plan that included theft protection for my new phone earlier this year. As long as Find My Phone is activated, they will replace it for a small fee, no police report needed. The only caveat is replacements can be only shipped to addresses in America.

For larger electronics, consider a Personal Articles Policy through State Farm or another insurer. It will cover gear that’s damaged or stolen anywhere in the world. A police report and proof of purchase is required for most claims for any insurance. (It’s hard to get a police report in some places. It also needs to be in English ideally but can often be translated.)

Age Limits

As with most insurance, travel insurance gets more expensive as you age. It’s difficult to find coverage over age 70. Some companies won’t cover you over age 65.

Which company is best?

I’ve used both International Medical Group (IMG) and World Nomads. (A travel company I previously worked for used IMG for the staff and that’s why I started using them.) They are cheaper than World Nomads, but World Nomads provides more benefits especially when it comes to adventure sports, which is why I used World Nomads for my Kilimanjaro trip. (World Nomad’s standard plan for one month is $118 compared to $42 for IMG for my age bracket.) World Nomad’s gives you two options where IMG gives you a plethora of options based on your deductible and coverage amounts. Overall, World Nomads has better coverage including coverage in the U.S. as long as you are 100 miles from your residence. IMG offers NO U.S. coverage in their standard plans. You get more with World Nomads so I recommend them for short trips, adventure trips or travel within the U.S. For long-term trips abroad, I found IMG to be more economical if I’m not in the U.S. or doing any adventure activities. Otherwise, I use World Nomads. (I haven’t had the best experience with IMG lately so I’m not sure I’d 100% recommend them in full honesty due to their massive delay in processing claims.)

Other companies: SafetyWing is another option for nomads with a set $250 deductible and $250K maximum limit for all plans. It offers U.S. coverage for non-residents only but this benefit doubles your premiums. A friend is using them currently but hasn’t filed a claim so I can’t speak to their response time on claims. Allianz is another highly known company, which does provide coverage in the U.S. for residents as long as you are 100 miles from your home. Cigna Global Individual plans include options for annual plans that will cover you up to 180 days per year in the U.S. if you are a resident. I haven’t used them personally, but friends speak highly of all three companies. IMG also offers annual plans.

Another option for medical evacuation only is a AirMed, an international air ambulance company, that costs $265/year for U.S. and Canadian residents. To qualify, you must be more than 150 miles from home AND you can’t spend more than 90 consecutive days abroad at a time. This combined with travel benefits from credit cards might be a good option if you only take short trips. They also offer family plans starting at $385/year.

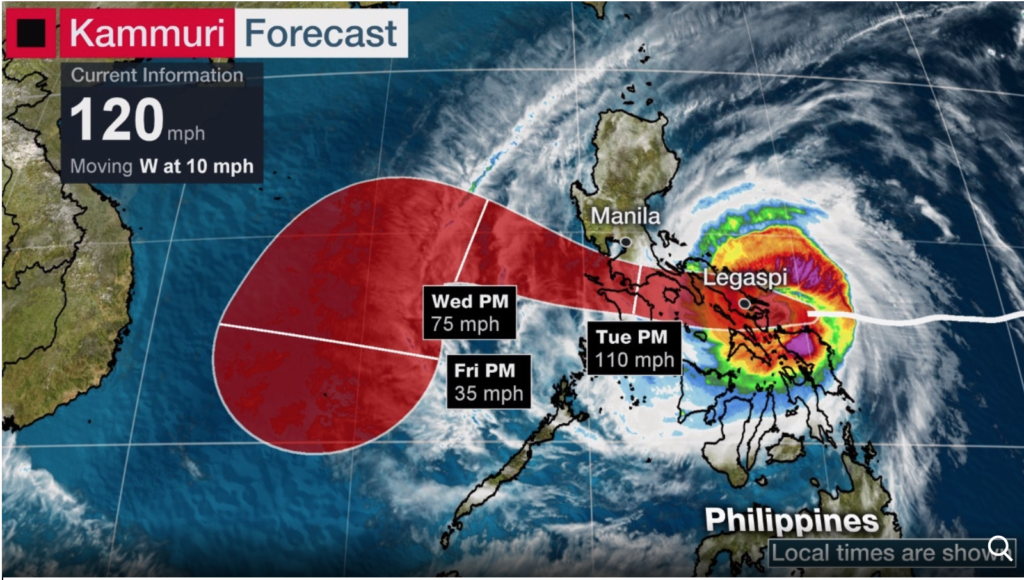

Travel Insurance Benefits from Credit Cards

Don’t overlook these benefits because they are very helpful and can be used as secondary insurance if you also have a travel insurance policy. Some credit cards include trip interruption, cancelation and delay with their benefits along with baggage delay and rental car insurance. I had to cancel a trip to the Philippines due to a typhoon last week so I made a claim on my credit card insurance to cover the flights since it was all purchased on the card. Check out my post about the outcome of the claim here! (My normal travel policy said it wasn’t covered by their cancelation benefit.)

Rental Car Insurance

Most U.S. car insurance policies will NOT cover you abroad so the rental car insurance benefit that’s included with many credit cards is critical. (My Chase Sapphire Reserve has excellent coverage so I use it to pay for all my rental cars!) Call your credit card company to ask about this benefit in advance. Some rental car companies will charge a small 2-3% fee to pay with a credit card to get you to pay in cash. Don’t fall for this – be sure to pay with your card to get the insurance benefit! It’s worth paying an extra two percent! (Allianz charges an extra $9 a day to include this on their travel plans proving that using your credit card is the key to saving money!)

Insurance FAQ’s

Should you keep your American health insurance while you travel long-term?

American health insurance is fairly worthless abroad since most things are out of network. You would have to pay and get reimbursed just like with a travel insurance policy. When I travel long-term for months at a time, I only have travel medical insurance when I am abroad because it’s WAY cheaper and has better coverage. (I talk more about this in this post!) The only exception for this rule would be if you have a pre-existing condition, which is why research is KEY! In January, I’ll be interviewing an American friend who’s a Type-1 diabetic who just went on a five-month honeymoon around the world with her husband.

What about Prescription Drugs?

Travel insurance does cover medication for any illness or injury during a trip; not pre-existing conditions. If you take medication regularly and will be quitting your job in the U.S. (no job usually means no insurance) to travel, be sure to request a vacation override to get an extra three months of your prescriptions in advance. Most insurance companies will do this! I always did this before I quit my job and my policy ended. Keep in mind most generic drugs like birth control and common antibiotics (doxycycline, amoxicillin, cipro, etc.) can be bought cheaply without a prescription overseas. (Always consult a doctor or pharmacist before taking medications. I often call a 24-hour pharmacy in the U.S. when I’m abroad if I have questions!) For example, most controlled substances are available in Thailand but require prescriptions and they must be obtained from pharmacies in hospitals. If you are on these types of medications, plan in advance.

Looking for travel insurance?

If you’d like to support this blog, consider buying your travel insurance through World Nomads using this link! The blog gets a small commission at no cost to you. (Full disclosure: The World Nomads links on this page are the only affiliate links.)

What to know more about medical care abroad?

For more details, check out my pervious post about Why You Should Go Abroad for Medical Care! For more details on travel insurance, check out these two episodes from two of my favorite travel podcasts: The School of Travels and Postcard Academy.